VenPays

One Payment Solution for All Transactions

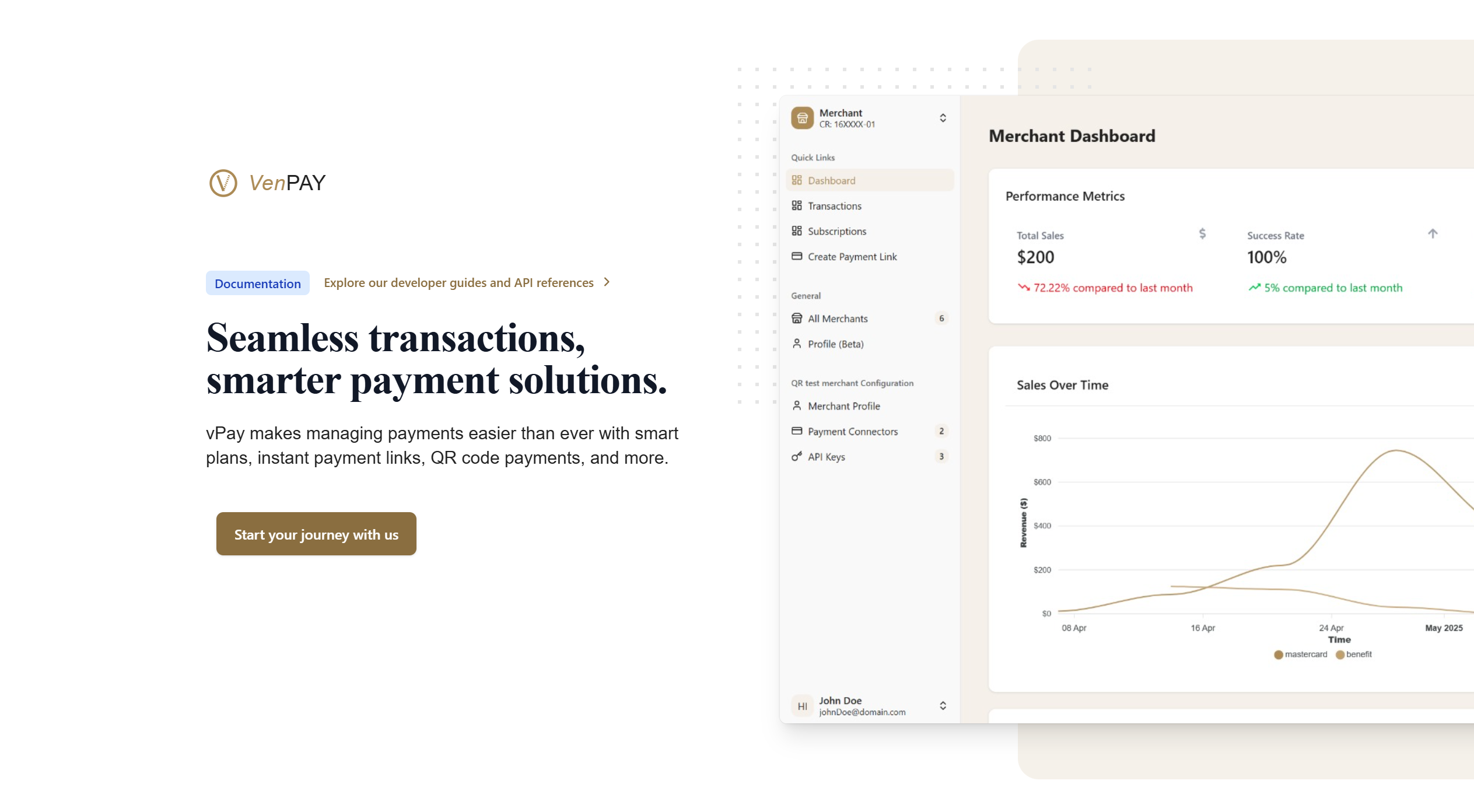

VenPays is a comprehensive digital payment platform designed for businesses to accept and process payments seamlessly across e-commerce, in-store POS, and digital wallets.

VenPays Development History

2025 - Feb

MVP Completed: Payment Processing & Reporting

We successfully completed the MVP, integrating essential modules for effective payment operations. This foundational step sets the stage for further enhancements.

Developed secure payment gateway supporting major credit cards and local payment methods.

Built detailed reporting dashboard providing insights into transaction patterns and revenue streams.

Implemented robust fraud detection system reducing fraudulent transactions.

2025 - Mar

Successful Beta Testing: Live Implementation in Businesses

Our beta testing phase was a success, with real businesses implementing VPay. Feedback from users has been invaluable for our ongoing improvements.

Processed test transactions with 99% accuracy during the beta period.

Onboarded 20 businesses across e-commerce, retail, and service industries.

Achieved average transaction processing time of under 2 seconds, exceeding industry standards.

2025 - Apr

Upcoming : Subscription System, VenAuth Secure Authentication

Upcoming milestones include the launch of our subscription system and integrations with VenAuth. These enhancements will further streamline user experience.

Developing advanced recurring billing options with support for trial periods and promotional pricing.

Creating seamless integration with accounting software for automated bookkeeping.

Implementing AI-powered fraud detection to continuously adapt to new threats.

Building a comprehensive customer portal for self-service payment management.

2025 - Jul

Upcoming : Alerts System and Seamless POS Connection Development

We are also working on an alerts system to keep users informed. The seamless connection with POS systems will enhance operational efficiency.

Designing real-time notification system for successful transactions and potential issues.

Developing advanced analytics to identify customer spending patterns and optimize pricing strategies.

Creating API-based integration system for easy connection with any third-party application.

Building a dedicated mobile application for on-the-go payment management and monitoring.